Geography

Australia is an island continent, lying between the Pacific and Indian oceans and neighboring with Indonesia, Papua New Guinea, East Timor, the Solomon Islands, New Caledonia, Vanuatu and New Zealand. The capital city of Australia is Canberra; two other largest cities are Melbourne and Sydney (Australian Government, Department of Foreign Affairs 2010). Australia is broken into six states and two territories, which include: Queensland, New South Wales, Victoria, South Australia, Tasmania, Western Australia, and the Northern territory and Australian Capital Territory. The rival states of New South Wales and Victoria form the core of Australia’s economy as the nations’ financial and service industries is located in these areas. However it should be noticed that with over 2.9 million square miles, Australia is nearly as large in area as the lower 48 states of the Continental US (Nolan, 1996).

Demography

Australia has a great number of its native plants, unique birds and animals (Australian Government, Department of Foreign Affairs 2010). Comprising the 10 per cent of the world’s biodiversity, Australia is committed to conserving its natural heritage and unique environment (Australian Government, Department of Foreign Affairs 2010). For this purposes, there is adopted a range of protection procedures, such as World Heritage listings, wildlife sanctuaries and national parks (Australian Government, Department of Foreign Affairs 2010). Australia is a multicultural society which includes Torres Strait Islander and Aboriginal peoples and migrants from almost all over the world (Australian Government, Department of Foreign Affairs 2010). An official language in Australia is considered to be English; however many Australians prefer to speak a language at home other than English (Australian Government, Department of Foreign Affairs 2010).

Environment

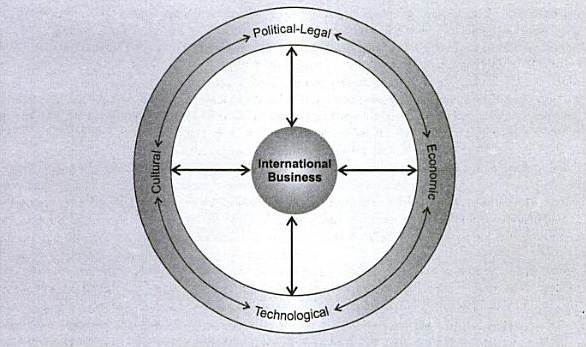

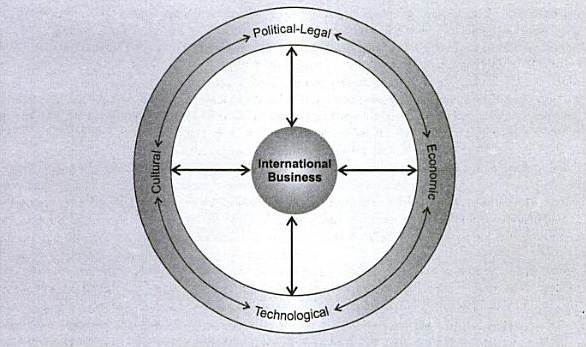

The international business climate is perceived, according to Aswathappa (2010), to be the cumulative total of all the external factors operating on the organisation as it interacts with its global and domestic markets.It is further mentioned that environments can be further classified into domestic, foreign and international spheres.

Figure 1: Environment of International Business

Source: Aswathappa (2010)

Australia has a phenomenal array of life types that are exceptional relative to the rest of the planet, representing its social political values and refugees through its vibrant society and lifestyle. Their behavior is mostly informal socially and in their relationship with their colleagues (Felsers, 2010).

The environment for international business is conceived as the interaction between domestic and foreign factors and revolves around political legal, economic, cultural and technological groups. These are also the risk factors like commercial risk, cross cultural risks, currency and country risk, both of which must be tackled before investing the country (Cavusgil, et al n.d.)

Cultural Environment

Culture is a great asset possessed by most of the organizations. According to Elbert W Steward and James A Glynn “culture consists of the thought and behavioral patterns that member of a society learn through language and other forms of symbolic interaction”. Most foreign companies take place within the political limits of nation – state and as such the dominant culture has the greatest impact on international business. Culture acts a barrier to mergers and acquisition and it serves as a control mechanism that shapes performance of employees, promotes innovation, energizes people in the company to do their job, and it provides members and members with a sense of belonging, enhances their commitment to their organization (Aswathappa, 2010). Cultural environment is an important factor considered by most of the companies in their action plan to decide whether to invest in the country.

Understanding the Australian market atmosphere in a business deal will alleviate stress and make it profitable and fun for all business parties (Nolan 1996). International businesspeople, dealing with an Australian counterpart, commonly experience cultural differences. The following discussion is designed to provide brief analysis of the cultural environment in Australia.

The business style of the average Australian businessperson can be described as direct, optimistic and informal (Nolan 1996). These people are very flexible; they are often able to reach compromises in business (Nolan 1996). Additionally, the Australian business culture is highly correlated with ethics. Even though bribery, underhanded dealings, under-the-table payments and other types of corruption do happen, it is neither culturally nor commonly accepted practice (Nolan 1996). Thus, the international businesspeople, coming from the countries where corruption is a common deal (for example, Post-Soviet Union countries: Russia, Ukraine, etc.) risk to loss the deal, to cause a scandal and/or to arouse legal action if the do not know the basic cultural principles of Aussies (Nolan 1996).

Nolan (1996, p. 139) states that “direct communication is highly valued in the Australian business community at all times, regardless of the situation surrounding a discussion; thus the Australian people take pride in saying what they mean and meaning what they say, and they expect the same of others”. Therefore, the businesspeople, whose words have varying meanings depending on a situation, should take into account the directness of Australians in order to avoid misunderstandings (Nolan 1996). Most people in Australia prefer informal style of communication, viewing formality as something absolutely burdensome and artificial (Nolan 1996). An overriding goal of the preferred informal communication is to make everyone feel comfortable (Nolan 1996). Thus, foreign business people should be prepared for abandoning established procedures, moving immediately to the use of first names among negotiating parties, or choosing not to dress to show power and wealth (Nolan 1996, p.139). Despite gender, race, age, class, income or business category, all people are treated in the same professional and civil manner in Australia (Nolan 1996).

Australian businesspeople expect that international visitors will be cordial, polite and knowledgeable about business (Nolan 1996). They expect that their foreign partners will be similarly oriented as they are, namely, concerned about profits, results, fairness and collegiality (Nolan 1996). Nolan (1996, p.140) explains that before doing business, Australians want to be “mates”. Thus, to receive the best response from Australian partners, international business people are advised to treat them in a friendly and respectful manner (Nolan 1996). Even though Australians have little cultural experience with bargaining, they tend to deal the view of their own interests (Nolan 1996).

Another essential cultural feature of Australians is their great focus on time management (Nolan 1996). Australia’s corporate activities and appointments arrive on schedule, and lateness can be used as an incredibly detrimental symbol (Nolan 1996, p.144).

Political and Legal Environment

The political environment refers to the effect on foreign business of the structure of government and judiciary in a country. The style and system of government prevalent in a nation determines, supports, facilitates, encourages, shelters, guides and regulates the country’s business. This is one of the risk factor which corporate organizations face when they conduct business with the outside world. Political risk is any government action or politically motivated event that could adversely affect the long term profitability and value of a firm.

Australia has democratic stability and a regional government structure of responsibilities that are normally divided between the federal government and state governments, both of which are ruled by elected parliaments(Feslers, 2010). Open, stable, and progressive political and legal environment of Australia attracts many international investors due its high degree of certainty and confidence (Australian Government, Department of Foreign Affairs and Trade, n.d.). Legal framework in Australia is efficient and transparent and corruption levels are very low comparing with the global indexes (Australian Government, Department of Foreign Affairs and Trade, n.d.). Australian legal system is developed from British Law with courts at both Commonwealth as well as States. The law enforcement responsibilities are shared between federal and state police forces. The legal system permits the acts to be passed by the federal parliament (Feslers, 2010). All these achievements are related to a strong system of checks and balances, and a highly respected law enforcement and judicial system (Australian Government, Department of Foreign Affairs and Trade, n.d.). Australian government offers full support with friendly foreign investment policy and has constituted Foreign Investment Review Board in 1976 to advise the Treasury and the government. The approach of government towards foreign investment policy is to encourage foreign investment consistent with community interests The FDI proposals are reviewed by FIRB and comments are sought from the government officials on large proposals whereas smaller proposals are exempted from Foreign Acquisitions and Takeovers Regulations 1989. The policy lays down various rules and regulations related to various service and industrial sector facilitating FDI as well as economic growth. (www.firb.gov.au).

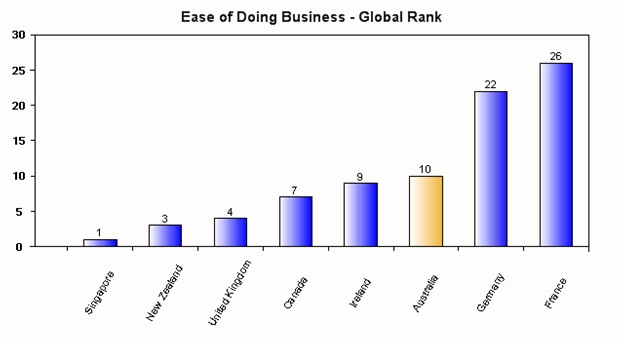

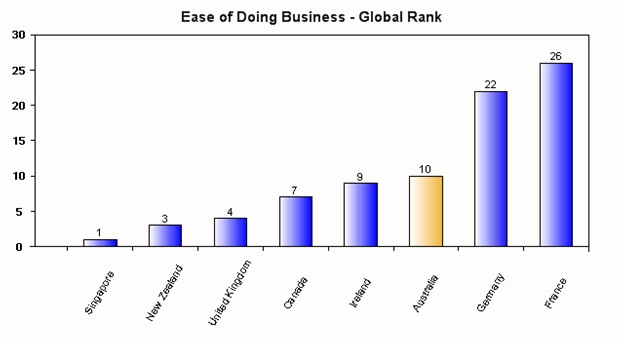

The Ease of Doing Business in Australia

According to the World Bank’s ranking on the ease of doing business, Australia takes the 10th position out of 183 possible (The World Bank 2010). Additional, the World Bank evaluates the country’s global position through such indicators: starting business, dealing with Construction Permits, registering property, getting credit, protecting investors, paying taxes, trading across boarders, enforcing contracts and closing a business (The World Bank 2010). Thus, for example, for starting business in Australia: it is required to complete 2 procedures; it takes only 2 days; and it costs only 0.7 % of income per capita (The World Bank 2010). For registering property, it is necessary to complete 5 procedures, and to spend 5 days for this operation (The World Bank 2010). Taxation issues are not as attractive for international businesspeople as in some other countries, because tax payers are required to pay taxes 11 times per year; these procedures require in total 109 hours per year; the profit tax is 25,9%; labor tax and contributions equal to 20,7%; the total tax rate (% profit) exceeds 47,9% (The World Bank 2010, p. 3).

The World Bank Report 2010

Table 1. Australia’s ranking in doing business 2011

(Source: The World Bank 2010)

Government Policies on International Trade, Direction and Terms of Trade, Attractiveness as a Site for Foreign Direct Investment

The foreign investment strategy of Australia promotes FDIs that are compliant with community priorities and are necessary to register and receive FIRB approval in some categories, such as new venture idea, investment in sensitive industries, purchase of properties and securities, and real estate (Feslers, 2010). Australian government welcomes foreign investments as it has helped built its economy and brings jobs and encourages innovation. The Foreign Investment Review Framework provides the policy and legislation comprising FATA acts which is the legislative framework for screening regime. The framework states that all foreign governments and their related entities can apply for FDI in the country. However the policy is quite liberal of US investors, with regard to monetary threshold, as $231 million applies in prescribed in sensitive sectors and $1005 million in other sectors thus encouraging US investment which is exhibited in Table 4. The decisions pertaining to the proposals are made in 30 days under the FATA which can be further extended upto 90 days by the Treasurer and considers application within the national interest, national security, other Australian government policies, impact on the economy and character of the investor (www.treasurer.gov.au).

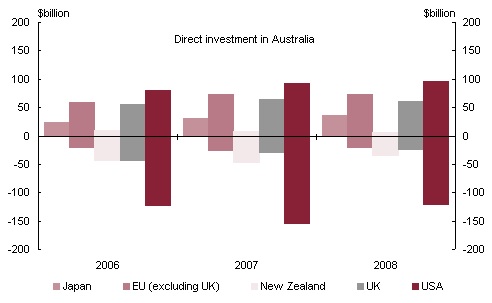

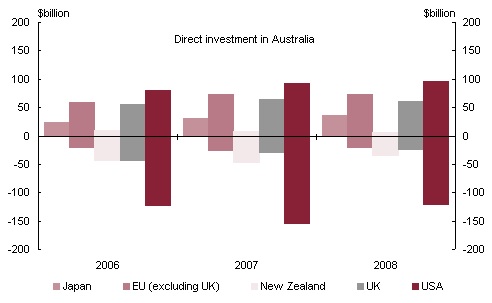

Foreign Investment Review Board (FIRB) was established in 1976 to look into the proceedings of the foreign investment proposals. According to Australian Bureau of Statistics (ABS), the stock of foreign investment in Australia at the end of December 2009 was $1,927.7 billion, an increase of $124.6 billion as compared to December 2008. The following graph shows that United States is the single largest source of inward as well as outward FDI followed by EU and UK.

Figure 2:- Level of FDIs by country

Source: www.firb.gov.au

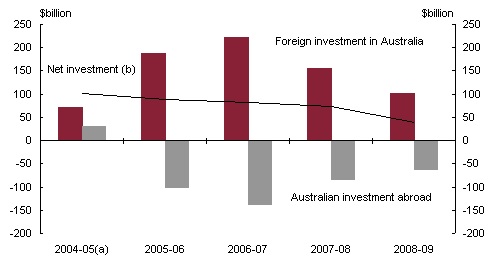

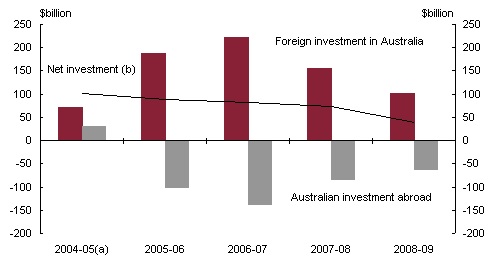

The following figure shows Australia remains a net importer of capital even in times of global recession which is more that it’s FDI abroad. (Fig.3)

Figure 3: Foreign investment flows 2004-05 to 2008-09

Source: www.firb.gov.au

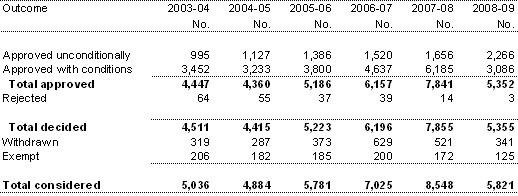

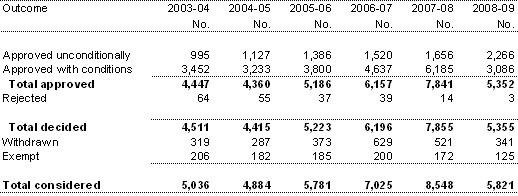

As per the most recent study revealed by the FIRB, it is clear that Australian government has put forth a friendly policy for FDIs which is shown below in Table 2 wherein the agency approved 5352 proposals out of 5821 in the year 2008-09 as compared to 8548 in 2007-08 (lower by 32%).

Table 2: Applications considered for the period from 2003-04 to 2008-09

Source: www.firb.gov.au

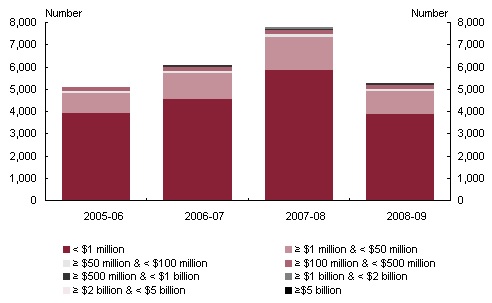

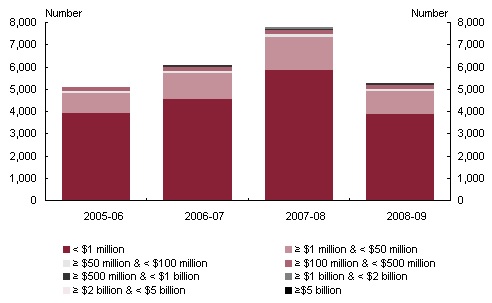

The following graph (Fig.4) shows that majority of the investments were above $1 million followed by $100 million and $5 billion investments, thus making it clear that Australia is a destination to do large scale business.

Figure 4: Total approvals by value 2005‑06 to 2008‑09 — number of proposals

Source: firb.gov.au

Though majority of the investments were above $1 million, it is pertinent to mention here that most of the proposals were accepted in the mining and service sector followed by finance and manufacturing sector giving an indication that Australia is the hot destination for service oriented firms and is hotbed for mining industries with 50% of proposed investments made in the mining industry which is shown in the diagram (Fig.5).

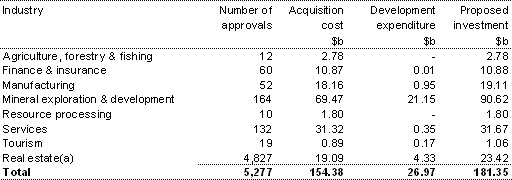

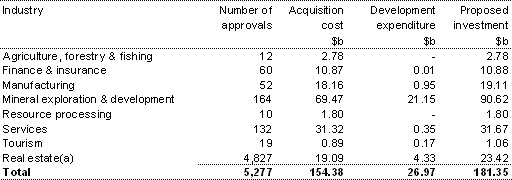

Table 3: Total approvals by industry sector in 2008‑09

Source: www.firb.gov.au

Fig 5: Total approvals by value by industry sector in 2008‑09 — proposed investment

Source: www.firb.gov.au

As shown above in Fig.2, United States is the major source of income through FDIs for Australian government. According to FIRB, 95 proposals of United States were approved with major investment in service sector amounting to $16,094 million and $19,798 million in mining sector. However China was the major investor in mining sector with $26254 million out of its total investment of $26599 in Australia. Japan made majority of its investment in mining sector while United Kingdom had invested $4336 million in finance sector. Out of the total investment of $166,709 million made in Australia during the year 2008-09, $90622 million was invested in mining sector followed by services sector. The detailed table presented below shows that Australia is a great nation to make future investments.

Table 4: Approvals by country of the investor in 2008‑09 — industry sector

Source: www.firb.gov.au

The Foreign Investment Policy of Australia also provides certain grants and incentives in form of tax deduction to investments made in scientific research and local manufacturing units, reduced rate of payroll taxes. The policy encourages export activities by providing various grants and tax rebates, incentives for developing RHQs in Australia. As such, Australia is ranked 10th by World Bank for foreign investors and ranked 2nd for starting a new business (World Bank, 2010).

Risk Factors

The Department and Foreign Affairs and Trade, Austrade & Export Finance and Insurance Corporation (EFIC) monitor the affects of political changes on Australian businesses and EFIC provides political risk insurance to help mitigate these risks which is an added advantage to the foreign investors and a kind of cooperation extended by the Australian government towards them. As the foreign investments are regulated under FATA and FIRB, differences in laws are expected and can affect the import procedures, taxation, employment practices, currency dealings, property rights, the protection of intellectual property, etc. However Austrade’s overseas offices provide assistance by recommending lawyers to tackle the issue (Australian Govt., Austrade). Australia in a Country Risk Tier (CRT) 1 region with very low levels of risk to the economic, political and financial environment and 18 years of continuous economic growth, according to the AMB Country Risk Survey (2010).

Participation in Cross-National Cooperation and Agreements, Regional Trading Blocks, FTAs and Other Forms of International Economic Integration

Australia’s international economic integration has been driven by the country’s participation in cross-national cooperation and agreements, regional trading blocks and Free Trade Areas.

-

The Organization for Economic Co-Operation and Development (OECD)

OECD is the main forum for monitoring and evaluating economic trend and developments in its 34 member countries (Australian Government, Department of Foreign Affairs and Trade, n.d.). Australia is one of the OECD member countries. Thus, the Australian membership of the OECD suggests the fundamental benefits of liberal democracy and free markets in improving the economic and social well-being of the country’s citizens (Australian Government, Department of Foreign Affairs and Trade, n.d.).

-

Association of Southeast Asian Nations (ASEAN)

The Association of Southeast Asian Nations (ASEAN) is aimed at accelerating economic growth, cultural development and social progress in the region (Australian Government, Department of Foreign Affairs and Trade, n.d.). Australia is the ASEAN first Dialogue Partner, and has a longstanding relationship with this organization (Australian Government, Department of Foreign Affairs and Trade, n.d.).

-

The Association of Southeast Asian Nations –Australia–New Zealand Free Trade Area (AANZFTA)

The Association of Southeast Asian Nations –Australia–New Zealand Free Trade Area (AANZFTA) is considered to be the largest Free Trade Agreement that Australia has concluded (Australian Government, Department of Foreign Affairs and Trade, n.d.). According to the Australian Department of Foreign Affairs and Trade (n.d.), ASEAN together with New Zealand account for 20% of Australia’s total trade on goods and services. AANZFTA provides commercially meaningful benefits through substantial tariff reduction and elimination commitments (Australian Government, Department of Foreign Affairs and Trade, n.d.).

The East Asian Summit (EAS) is an important regional grouping which it plays a major role in fostering stronger political integration and collaboration in East Asia (Australian Government, Department of Foreign Affairs and Trade, n.d.). Membership of the EAS comprises 16 countries, including Australia (Australian Government, Department of Foreign Affairs and Trade, n.d.).

-

The Australia-United States Free Trade Agreement (AUSFTA)

AUSFTA is an agreement between the United States and Australia, which covers goods, services, government procurement, investment, telecommunications, e-commerce, intellectual property rights, competition related matters, standards and technical regulations, labor and the environment (Australian Government, Department of Foreign Affairs and Trade, n.d.).

-

The Thailand-Australia Free Trade Agreement (TAFTA)

The Thailand-Australia Free Trade Agreement (TAFTA) contains commitments to undertake inbuilt agenda negotiations on government procurement, services, business mobility, investment and competition (Australian Government, Department of Foreign Affairs and Trade, n.d.). Australian business is encouraged by the notable benefits and opportunities created by TAFTA (Australian Government, Department of Foreign Affairs and Trade, n.d.). Thus, for example, Thailand eliminated its tariffs significantly, and plans to phase all remaining tariffs to zero in the next 10-15 years (Australian Government, Department of Foreign Affairs and Trade, n.d.).

-

The Singapore-Australia Free Trade Agreement (SAFTA)

The Singapore-Australia Free Trade Agreement (SAFTA) is an agreement aimed at strengthening trade and investment links between Singapore and Australia (Australian Government, Department of Foreign Affairs and Trade, n.d.). The agreement eliminates tariffs, improves increased market access for Australian exporters of services and provides a more open and predictable business environment across different areas, including intellectual property, competition policy, e-commerce, government procurement, business travel and customs procedures (Australian Government, Department of Foreign Affairs and Trade, n.d.).

-

The Australia-Chile Free Trade Agreement (FTA)

The Australia – Chile Free Trade Agreement is a significant market opening agreement for Australia. According to the Australian Government, Department of Foreign Affairs and Trade, it will reduce tariffs on 97% of goods currently traded (Australian Government, Department of Foreign Affairs and Trade, n.d.). Additionally, the tariffs on all existing merchandise trade between Chile and Australia will be eliminated by 2015 (Australian Government, Department of Foreign Affairs and Trade, n.d.). Additionally, Australia is a member of the World Trade Organization, the Cairns Group, and the Asian-Pacific Economic Cooperation (Australian Government, Department of Foreign Affairs and Trade, n.d.).

Conclusion

Australia is one of the best places for international business as it has created incentives to entice foreign investors providing opportunities in the areas of industrial and infrastructure development. Australian financial services are among the most competitive and sophisticated which is added advantage to the companies investing in the country. Moreover, the island of Australia is strategically positioned as a perfect intermediary for trade between Asia and the rest of the world convenient to shipping routes as well as airways. It is both a potential source for those seeking suppliers worldwide and a prime location from which to serve the rapidly growing Asian market. Human resource is important tool for any organization in order to achieve success in its endeavor, Australia has great human resource, skilled and well educated, and many of whom can speak one or more Asian languages, thus making it prime location for regional operating headquarters (Nolan,1996). Thus Australia is one of the hot destinations to make investment in view of its demography and socio economic ability offering good market.